- Scoops

- Posts

- 🔍Scoops Spotlight

🔍Scoops Spotlight

Breaking down the latest news impacting your life, business, and money.

Hey friends - if you’re feeling overwhelmed by the news cycle lately, don’t worry. I’m essentially a professional news reader, using tech to consume news at an accelerated rate, and even I feel like I can’t keep up right now. And whether it’s AI advancements, political scandals, trade announcements, geopolitical conflict, protests, policing, or even just the friggin weather - every news alert feels like it’s a warning of the end of civilization.

Do you feel like this, too? |

But I resolved this year to work at finding positive perspectives. And the economy, at least, beneath the scary headlines, seems to be trending in a positive direction. Albeit very slowly and delicately, with plenty of things that could go wrong.

Welcome back to the weekly Scoops Spotlight, where we’ll serve up a little summary of the most important business and money news of the week with the company scoops that got the most community reactions.

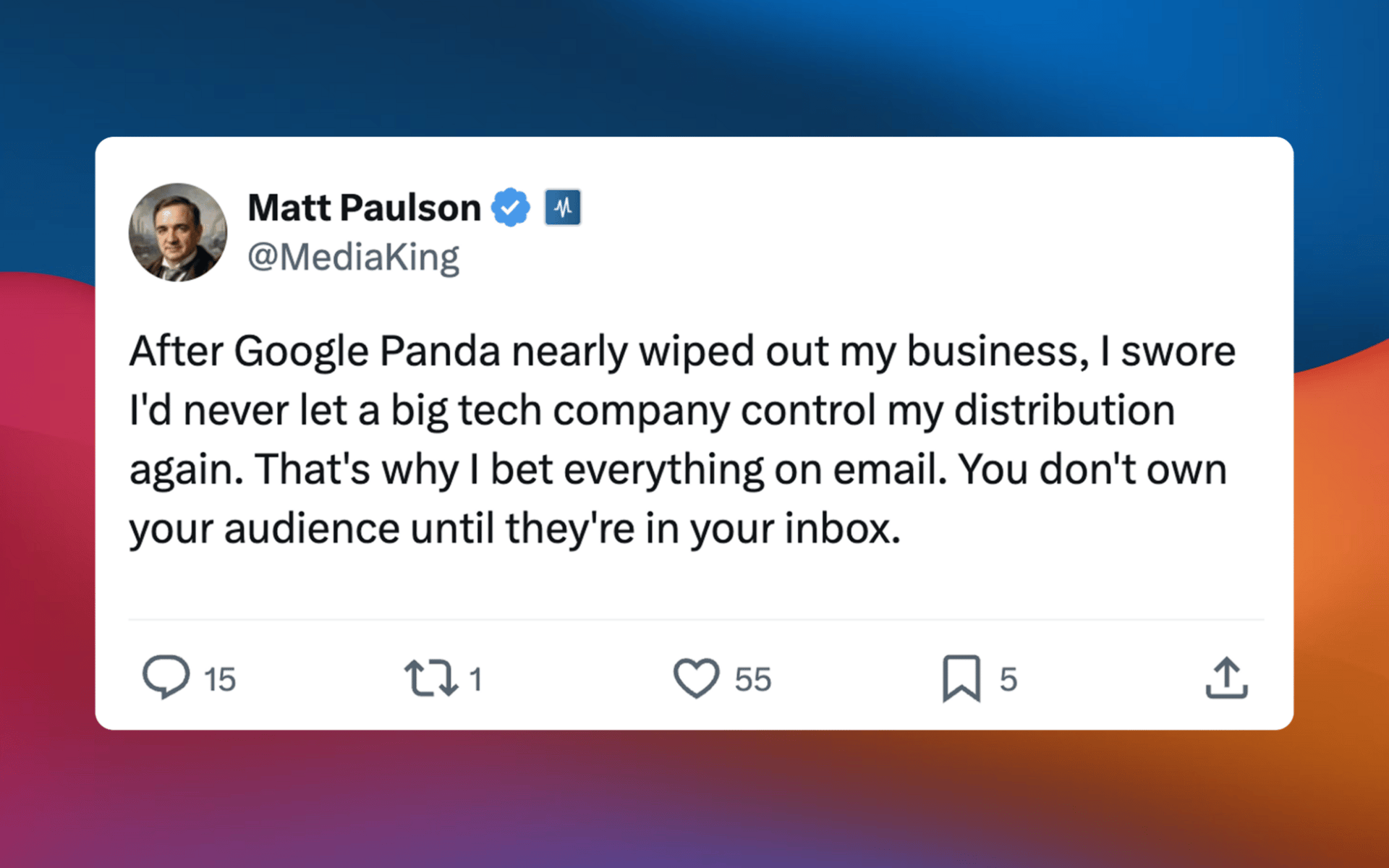

Why is everyone launching a newsletter?

Because it’s how creators turn attention into an owned audience, and an audience into a real, compounding business.

The smartest creators aren’t chasing followers. They’re building lists. And they’re building them on beehiiv, where growth, monetization, and ownership are built in from day one.

If you’re serious about turning what you know into something you own, there’s no better place to start. Find out why the fastest-growing newsletters choose beehiiv.

And for a limited time, take advantage of 30% off your first 3 months with code LIST30.

🌎 The Big Picture

The main thing people are freaking out about this week is AI. That’s not new, though, so if someone’s screaming market collapse, push the pause button and take a breath. Even the leading minds in AI can’t forecast what’s going to happen, and the people building the most advanced AI platforms are unleashing breakthroughs faster than they ever expected.

Change is scary. And the main thing happening right now is that this AI tech evolution, to anyone that’s paying close attention, is changing the way we see the world, our operating models, and ways of making money far more quickly than anyone can grasp.

The AI boom has been the main driving force behind the growth of the stock market over the past year or more, and truly much of the growth of the economy. Throughout the rally, investors have tried to wrap their minds around what’s happened, going through waves back and forth between “this is going to change everything and make everyone more money” to “this is a waste of money that won’t turn into value fast enough” to now, this week, more of a “this is too much money going into tech that will change everything quickly but not necessarily drive great profits for everyone.”

Google’s release of Gemini 3 at the end of the year, and then Anthropic’s following updates to Claude Code and Claude Cowork, started shifting investors from thinking that AI is a lift-all-boats kind of tech to recognizing that there will be winners and losers. Google stock has been crushing it because the main determinant of who can win will be who has enough cash flow to burn to maintain this pace of innovation. Google has one of the best cash machines in the world.

This week, investors really got nervous that AI isn’t just going to create winners, but that it could be an industry killer. The latest releases of AI agent tools had a shock factor at the level of ChatGPT’s original release. Fully autonomous agents built their own social media platform with hundreds of thousands of independently interacting agents. They built software in minutes, created religions, and many other scary and fun and exciting breakthrough examples that can easily be called over-hyped or exaggerated, but that showed everyone that the next wave of autonomous operations is here. Then, Anthropic released new tools that put its groundbreaking AI agents into legal and finance tools, showing how these things aren’t just fun side project tools, but that they could make white-collar jobs, from software creation to legal reviews to financial analysis, completely obsolete - not in 10 years. Now.

In combination with that, the biggest tech firms announce the most aggressive plans to invest in more AI this year - hundreds of billions of dollars pouring into this tech. Some of these companies have the money to do it sustainably, but some of them will be burning most of their cash flow.

On top of that, the latest jobs numbers pointed to a spike in layoffs and stalled hiring, adding to the narrative that “Big tech is burning a potentially unsustainable amount of cash for this new tech that may already be stalling hiring and spurring layoffs and could kill entire industries.”

So, obviously, the tech story is a little too aggressive. AI will accelerate and complement existing tech. The drama of the storyline has been emphasized by the market selloff this week, but the market was already near record highs, priced to perfection with massive optimism. This selloff could have happened this week without any of this news.

And the jobs market headlines are a little more about clickbait. Everyone knows hiring has stalled. There have been barely any net new jobs added in the last 6-12 months. There are plenty of arguments to make about why that’s happening, from general policy uncertainty, to lack of available talent, growing costs, and weather before you even get to AI. Initial unemployment claims did rise last week, but they have been historically low. And corporate layoff announcements were really high in January, but that was mainly driven by tens of thousands of job cut warnings from three companies: Amazon, UPS, and Dow. That likely says more about consolidation and the corporate policy shift from employee loyalty to perpetual prioritization of short-term profit maximization regardless of business health. Of course, job data is a backward-looking number, so there are warning signs in these reports, but not the ones implied by the headlines right now.

So what does all of this mean? Ride it out. The economy is doing pretty well, with many signs pointing to marginal improvements in costs, hiring, and business activity over the course of the year ahead.

How are you feeling about the economy? |

🏭 The Companies Everyone’s Talking About

Amazon is ramping up cloud investment while cutting corporate roles and grocery stores. | Amazon is pouring far more money into building computing capacity while trimming the parts of the business that have not paid off. Amazon’s cloud unit grew 24% in the quarter, strengthening the case for prioritizing data centers over slower experiments. The plans to invest $200 billion in 2026, mostly aimed at Amazon Web Services data centers and AI infrastructure. At the same time, the company is shrinking its corporate workforce again and exiting its Amazon Fresh and Amazon Go store formats, shifting some locations into Whole Foods instead. The tech giant plans to cut 16,000 corporate roles, bringing total announced white-collar job reductions to about 30,000 over the past three months. After a hiring surge during the pandemic, Amazon is refocusing on speed, accountability, and leaner teams. |

Palantir accelerated revenue, deepening its reach into defense and business software. | Palantir accelerated its role as an AI operating partner for the US government and a fast-scaling software vendor for businesses last quarter. The data-analytics contractor grew fourth-quarter revenue 70% year over year to $1.41 billion, with US government revenue at $570 million and US commercial revenue at $507 million, showing strength on both sides of its core franchise. Palantir also set a much higher growth bar for 2026, targeting over $7 billion in annual revenue, thanks to projects like military mission-control system Maven. At the same time, its expanding work with Immigration and Customs Enforcement keeps the company in the spotlight, tying growth to heightened scrutiny around how its tools are used. |

Southwest is reshaping seating by replacing open boarding with assigned seats. | Southwest Airlines is officially ending its 54-year open-seating tradition and moving to assigned seats for all passengers, making boarding feel more like other major US airlines. The shift is designed to give travelers more certainty and to create new ways to earn money for the carrier, like charging extra for preferred and extra-legroom seats that can cost more than $70 per flight segment. Plus-size travelers who need extra space are now required to buy additional seats upfront. These changes mean fewer surprises at boarding but higher upfront costs for some customers. |

Novo Nordisk is launching Ozempic tablets in the U.S. this spring. | Novo Nordisk is simplifying diabetes care with FDA approval of an oral version of Ozempic. The pill delivers the same treatment without injections, making it easier for patients to start and stay on therapy while expanding access to a drug already widely recognized by doctors and insurers. By reducing barriers to treatment, the pill could bring more consistency to diabetes management and lower the risk of serious complications like heart attacks and strokes. By unifying its oral and injectable semaglutide options under one well-known brand, the drugmaker is trying to make prescribing and pharmacy conversations simpler while keeping patients on a familiar treatment path. Over time, that could ease pressure on employer health plans and insurance premiums, while strengthening Novo Nordisk’s position as a leader in the fast-growing metabolic and preventative care market. |

Alphabet doubled down on AI spending as its cloud business gains ground. | Alphabet is pouring far more money into data centers, chips, and computing capacity to push AI deeper into its products and cloud business. The tech giant laid out a $175 billion to $185 billion capital spending plan for 2026 as it tries to meet rising cloud demand and improve search and advertising performance with AI-driven features. That push is showing up in cloud results, with revenue jumping nearly 48% and a growing backlog that reached $240 billion. At the same time, the company is trying to make the AI economics work by cutting Gemini serving unit costs 78% over 2025. Despite the heavier spending, Google maintained confidence in its ability to manage costs while continuing to invest for the future. |

❔ The Big Question of the Week

Scoops app users: We have taken the beta app offline for a short period for some major updates. Can’t wait to show you all what we’ve been working on! Reach out if you have any questions.

We’re going to switch up the content in this spotlight for a bit to make sure you all have the info you need to master your week.

Reply